This is mainly used to report gains from the sale of real estate that was strictly used as business property. In that case, any gains from the sale of your primary residence would be deemed eligible for the capital gains tax exclusion. Notably, though, if you happen to work from home and you're selling your primary residence, you likely will not need to fill out this form. Lastly, this form should also be used if your business was subject to involuntary conversion or recapture. Gains from the sale of properties that are used for oil, gas, geothermal, or mineral purposes should also be included on this form. This can include but is not limited to any property that was used to generate rental income or a home that was used as a business.Īdditionally, IRS Form 4797 is used to report gains from the sale of property that was used for industrial, agricultural, or extractive services. What is IRS Form 4797?įorm 4797 is a tax form to be filled out with the Internal Revenue Service (IRS) for any gains from the sale or transfer of property that was used for business purposes. Read on below to learn what you need to know about this form before submitting it to the IRS. With that in mind, below is a closer look at this form, what you should know when filling it out, and how it differs from a Schedule D. The only thing they care about is getting your money.If you've bought or sold a property that was used for business purposes within the last year, you're going to need to fill out IRS Form 4797 in addition to your regular tax return. Even if you think you are in the same tax year, you can still claim refunds or receive tax reductions if the dates don’t match up.Ī simple concept, right? The IRS does not care how difficult it may be to complete a tax return. For example, you may think you are in a different tax year but you are not. The thing to remember when using the 1031 Exchange Worksheet is that you must determine whether or not you are in the same tax year as another taxpayer. 1031 Exchange Tax Worksheet and 1031 Exchange Excel Spreadsheet No one wants to file late because they were misinformed by the IRS. Let’s face it the rules are so confusing these days that someone may claim they did not make a purchase that was included in their sales statement or invoice, only to discover later that they must pay an extra tax. The IRS cannot prove anything about your tax situation if you do not provide them with accurate information. Your tax return needs to be completely accurate. In order to claim any taxes, you need to know exactly what you are supposed to pay. It is also important to make copies of the forms and the 1031 Exchange Worksheet for your own records. All taxpayers should keep copies of this tax form for reference and in case they need more time to prepare their tax returns.

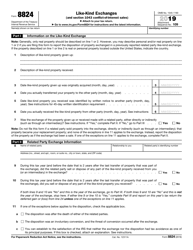

#IRS FORM 8824 WORKSHEET CODE#

This is a great part of the tax code and it is useful for everyone. 1031 Exchange Calculation Worksheet and Sec 1031 Exchange Worksheet To make matters worse, the IRS tells taxpayers to refer to the document every year, because the information contained in the worksheet has not changed. This leaves the taxpayer without an income tax return. The only problem with this is that it is so easy to lose or delete the worksheet completely.

#IRS FORM 8824 WORKSHEET DOWNLOAD#

The IRS actually allows taxpayers to download the 1031 Exchange Worksheet. Any excuse is good enough for the IRS, as long as it is reasonable and the taxpayer complies with the request. The IRS does not want taxpayers being late in filing their tax returns. This tax form was designed specifically for taxpayers who need additional time to prepare their tax returns. There are so many versions of this worksheet available and the IRS seems to have little trouble changing the wording on the worksheet.

As long as you have a copy of it, you will not be treated as if you do not have any income to report. It would be unfair to assume that the IRS actually knows what the 1031 Exchange Worksheet is.

0 kommentar(er)

0 kommentar(er)